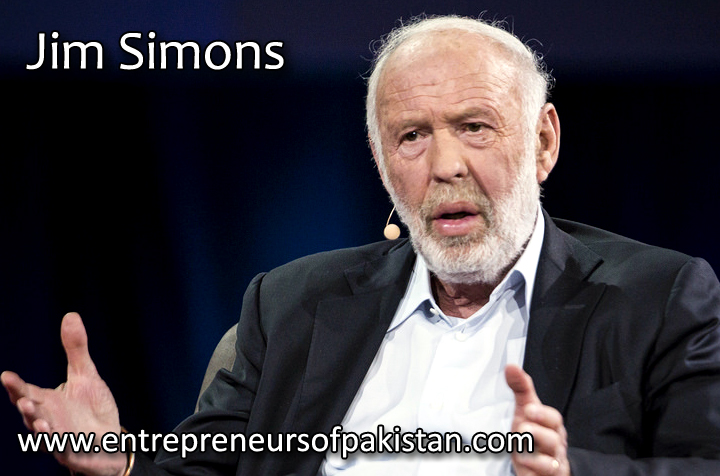

James Harris Simons, born on April 25, 1938, in Newton, Massachusetts, demonstrated an early affinity for mathematics, setting the stage for his groundbreaking contributions to finance.

Educational Background: Simons earned a Bachelor’s degree in mathematics from the Massachusetts Institute of Technology (MIT) and a Ph.D. in mathematics from the University of California, Berkeley. His academic prowess laid the foundation for a remarkable career.

Distinguished Academic Career: Before venturing into finance, Simons achieved recognition for his contributions to mathematics. He served as a professor at MIT and Harvard, leaving an indelible mark on the field with his groundbreaking research in geometry and topology.

Transition to Finance: In 1982, Simons founded Renaissance Technologies, a private hedge fund management company. His innovative use of mathematical models and quantitative strategies set Renaissance apart, transforming the landscape of financial investing.

Revolutionizing Quantitative Trading: Under Simons’ leadership, Renaissance Technologies became a powerhouse in quantitative trading. The firm’s flagship fund, the Medallion Fund, consistently delivered exceptional returns, showcasing the effectiveness of data-driven investment strategies.

The Medallion Fund’s Success: Simons’ Medallion Fund gained legendary status for its consistent and extraordinary returns, outperforming traditional investment strategies and solidifying its place among the most successful hedge funds in history.

Mathematics Meets Finance: Simons’ unique approach bridging mathematics and finance revolutionized the industry. His firm’s use of complex algorithms and statistical models marked a paradigm shift, influencing how investors approached financial markets.

Philanthropy and Scientific Contributions: Simons’ influence extends beyond finance. Through the Simons Foundation, he has supported various scientific research initiatives, contributing to advancements in mathematics, physics, and the life sciences.

Legacy and Continued Impact: Jim Simons’ legacy endures not only in financial history but also in the ongoing impact of quantitative finance. His ability to merge mathematical rigor with financial acumen has left an indelible mark on the investment landscape.